MUTUAL FUNDS

What is a mutual fund?

A mutual fund, as the word suggests is a mutual collection of funds placed in a structured manner to build a machine that runs on money collected from investors, which invest in bonds, stocks, money instruments, etc. This machine is operated by trained money managers who assign various assets of the funds in a way that produces income for the investors.

With Mutual funds, individual investors can invest their money in skillfully managed portfolios distributed amongst equities, bonds, and other securities. For all the portfolios, their respective shareholders are equal participants in gains or losses incurred within a fund as each part represents the investor’s share ownership in the fund.

Highlights:

- Mutual fund is a mutual collection of funds

- Investors put their investments in a rich portfolio featuring bonds, stocks, or money instruments, etc.

- Mutual funds are distributed amongst equities, bonds, and other securities

- Mutual fund is a growth industry covering a large spectrum of investment schemes

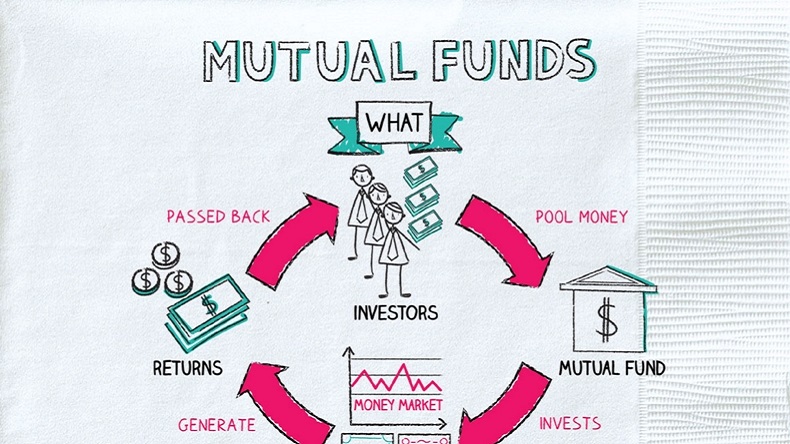

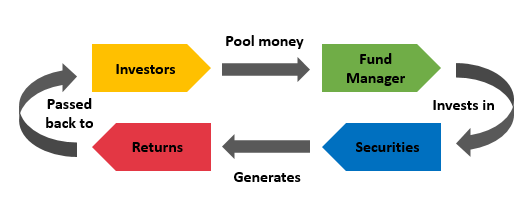

Let’s look at a flow chart for better representation of a mutual fund in action:

TYPES OF MUTUAL FUNDS

Equity fund- Investing in an equity equals to buying company shares with an aim to provide the benefit of professional management to ordinary investors. An equity fund provides capital appreciation through medium and long term investment.

An equity fund is comparatively high risk, and Equity schemes provide multiple options to invest such as, dividend option, capital appreciation, etc.

Debt/Income funds – Income or Debt funds work to provide a steady income to investors. Such funds generally invest in fixed income securities such as bonds, corporate debentures, government securities and money market investments. These funds are comparably less risky than equity schemes.

Balanced Fund – A moderate growth fund that aims at both growth and regular income. They are a combination of an investment made in equities and fixed income securities per the agreed proportion on offer documents.

Index Funds – These funds are passive funds mimicking stock market index such as BSE Sensex, NSE Nifty, etc. The investment goes into all the stocks making up the index and these rise or fall in a harmony to index.

Liquid Funds – These funds stand for easy liquidity with protected capital. Liquid fund investments are short-term similar to inter-bank call money market, CPs and CDs, etc. They are short-term cash management schemes and are invested for 1day to 3months.

Three possible ways to make money using mutual funds:

- Earning from interest on bonds and dividends on stocks

- Increase in security price (‘capital gain’)

- Increasing fund share prices